Outlook for 2025

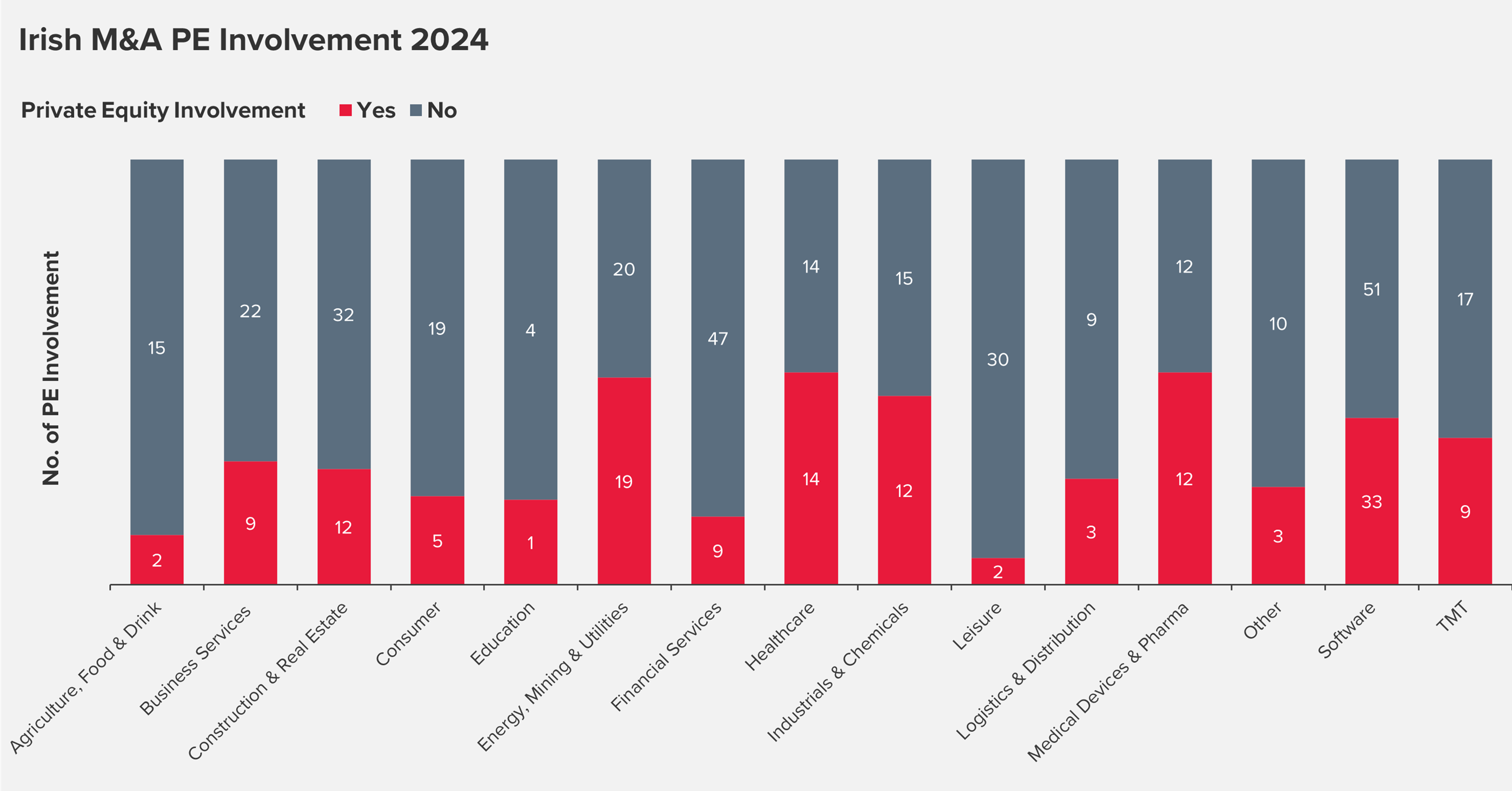

Moving into 2025, the Irish M&A market remains strong, with business confidence improving as inflationary pressures ease and interest rates stabilize. PE firms are expected to maintain high investment levels, while strategic buyers with strong cash reserves will look to enhance capabilities through acquisitions. However, divestments by large corporates are also expected as businesses refocus on their core operations.

Key global megatrends, including digitization and decarbonization, will continue to shape deal activity, particularly in technology, renewable energy, and financial services.

Valuation & Deal Structuring

Valuations remain sector-specific, with many transactions undisclosed. Business owners looking to sell must engage advisors to assess market positioning, optimise deal structures, and implement tax-efficient planning.

Deals are taking longer to complete due to heightened due diligence requirements. Vendor due diligence is now critical, signalling seller commitment and enhancing buyer confidence. Beyond financial and legal checks, buyers are expanding due diligence efforts to commercial, IT, HR, and ESG compliance, particularly with the introduction of Corporate Sustainability Reporting Directive (CSRD) regulations.

Increasing Complexity in Deal Execution

Deals are taking longer to complete, requiring careful structuring to mitigate risks. Vendor due diligence is increasingly becoming a pre-requisite, demonstrating seller commitment while attracting a broader pool of buyers. However, due diligence now extends beyond financial and legal considerations. Buyers are seeking comprehensive risk assessments, covering:

- Commercial viability

- Technical infrastructure

- IT security & cybersecurity threats

- HR and talent retention

- Environmental, Social, and Governance (ESG) compliance

ESG considerations are particularly important with the introduction of Corporate Sustainability Reporting Directive (CSRD) compliance, which affects businesses across industries. Companies must be proactive in understanding their obligations and the potential impact on their supply chains and customer relationships.

Regulatory & Policy Impacts

Regulatory and policy changes will continue to shape the M&A landscape, particularly in areas such as:

- Foreign direct investment (FDI) restrictions

- Cybersecurity and data privacy laws

- Evolving ESG frameworks

These factors are influencing how deals are structured and executed, adding layers of complexity that companies must navigate carefully.

Ireland’s Position as an Investment Hub

Despite these challenges, Ireland remains an attractive M&A destination, benefiting from:

- A strong, stable economy

- A well-established financial services sector

- A favourable investment environment as a gateway to the EU

However, external factors—particularly U.S. policy changes—will be closely monitored, given their potential impact on Irish businesses and international capital flows.

For companies considering a transaction in 2025, the key will be preparation, agility, and strategic alignment. With a strong pipeline of capital available and continued interest from international investors, Ireland’s dealmaking environment remains well-positioned for sustained growth.